The Next Wave in

Tech and Trading

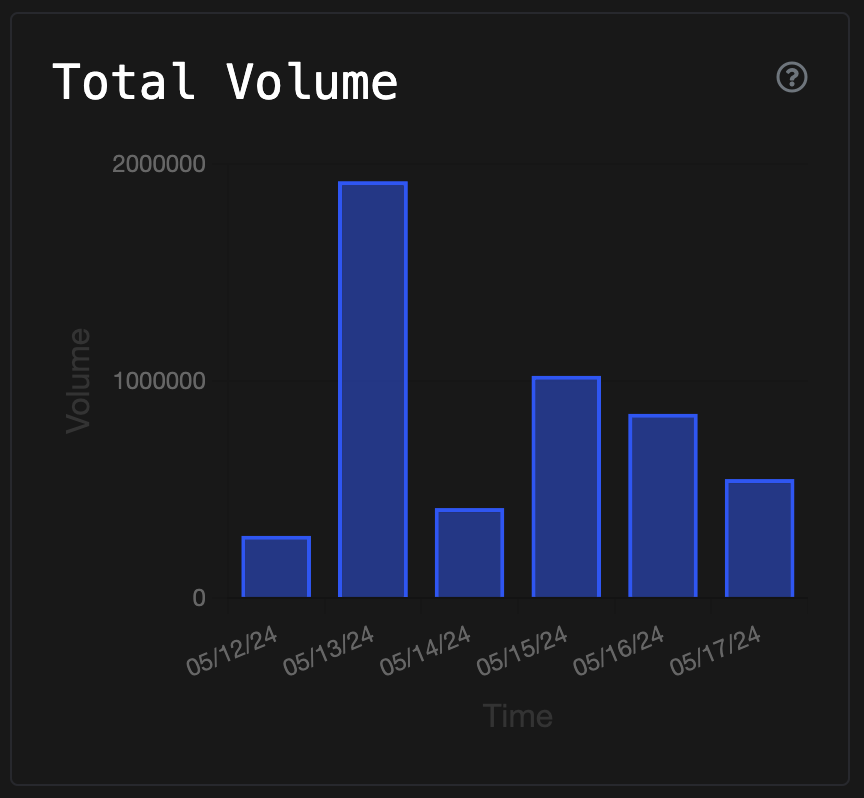

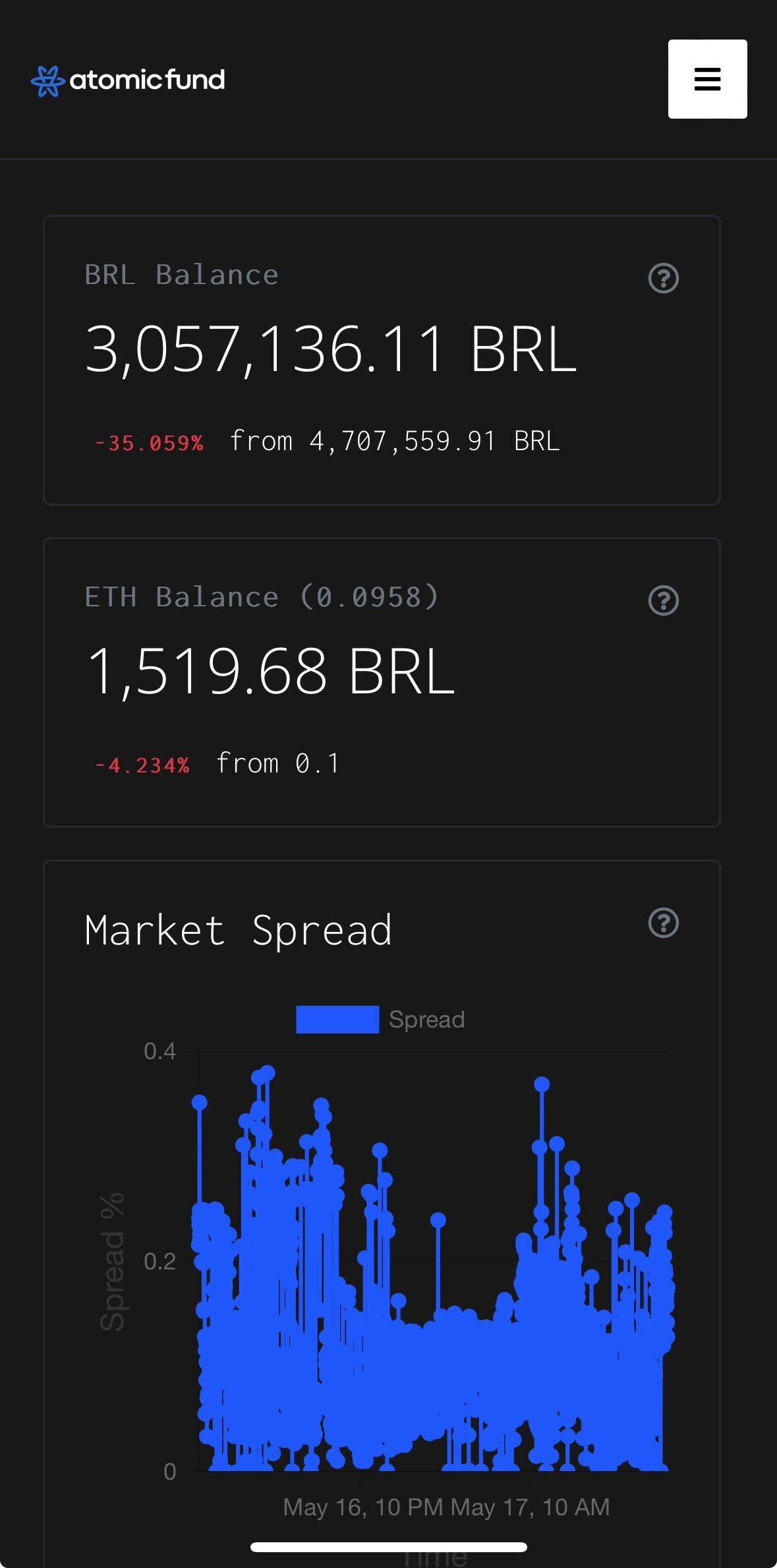

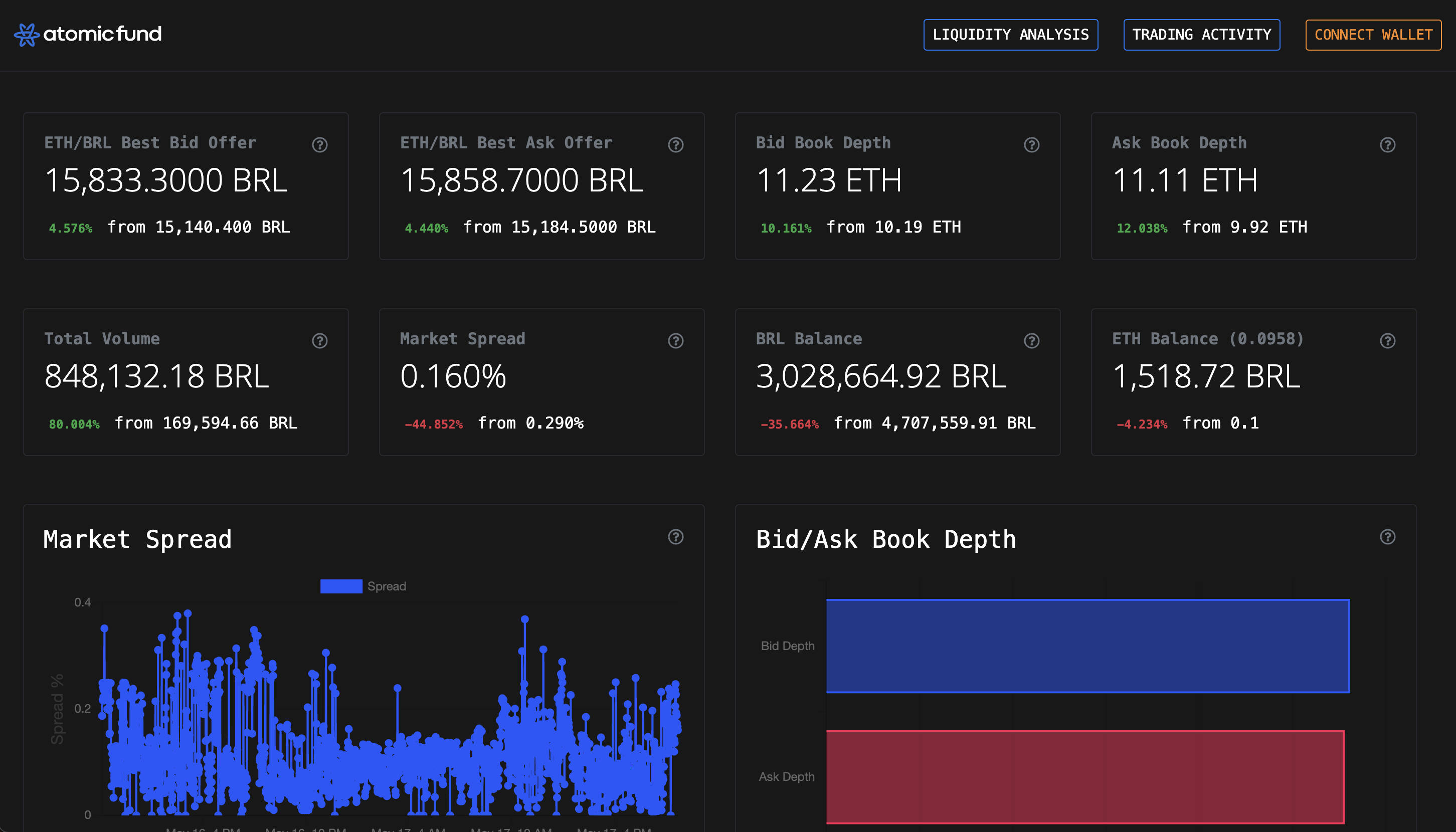

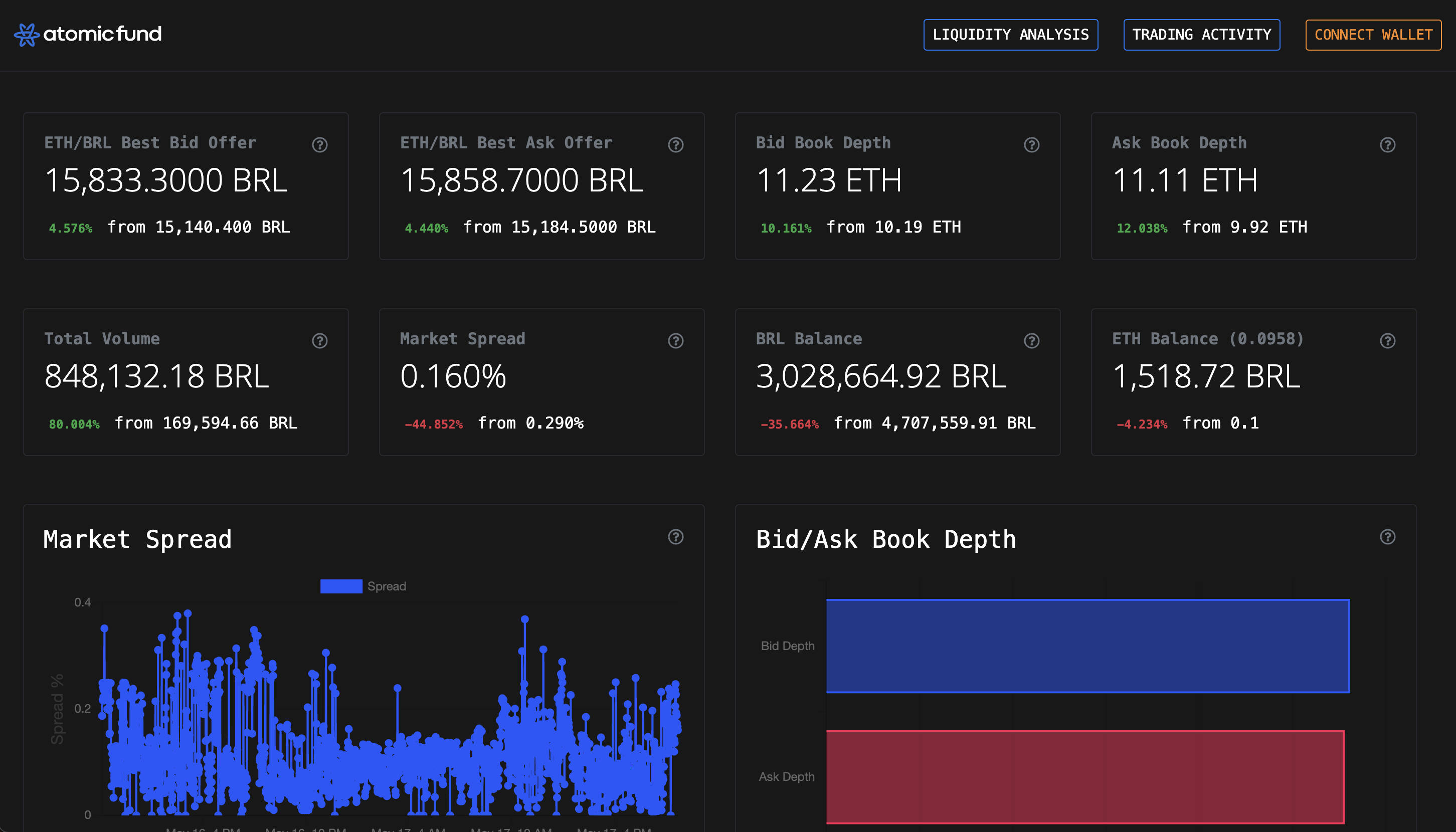

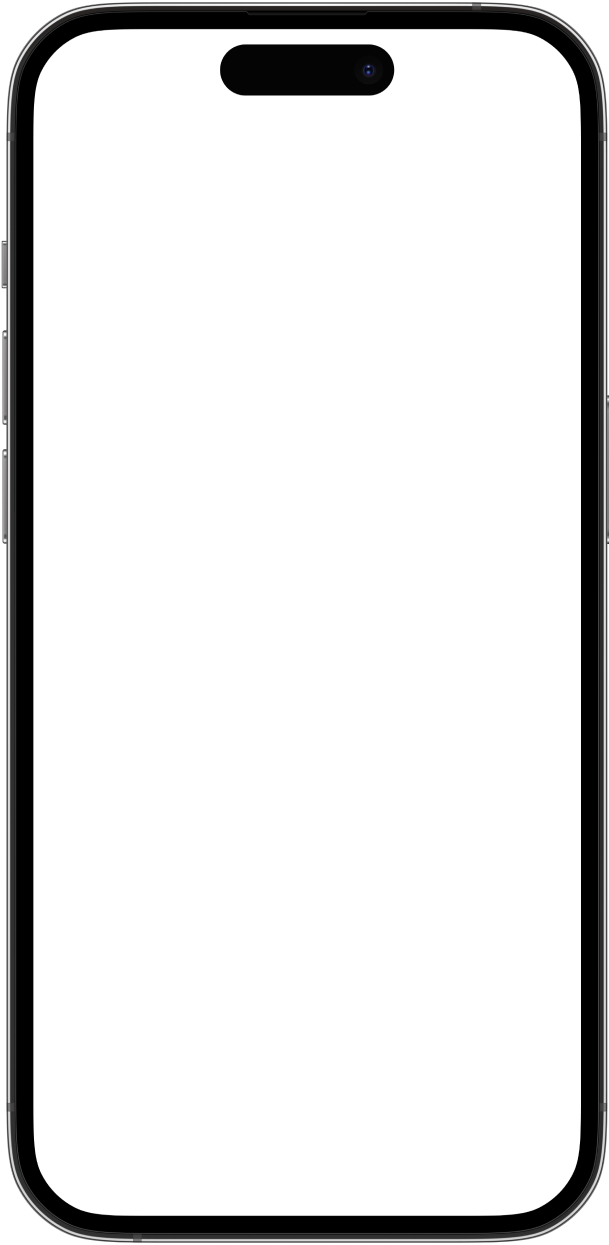

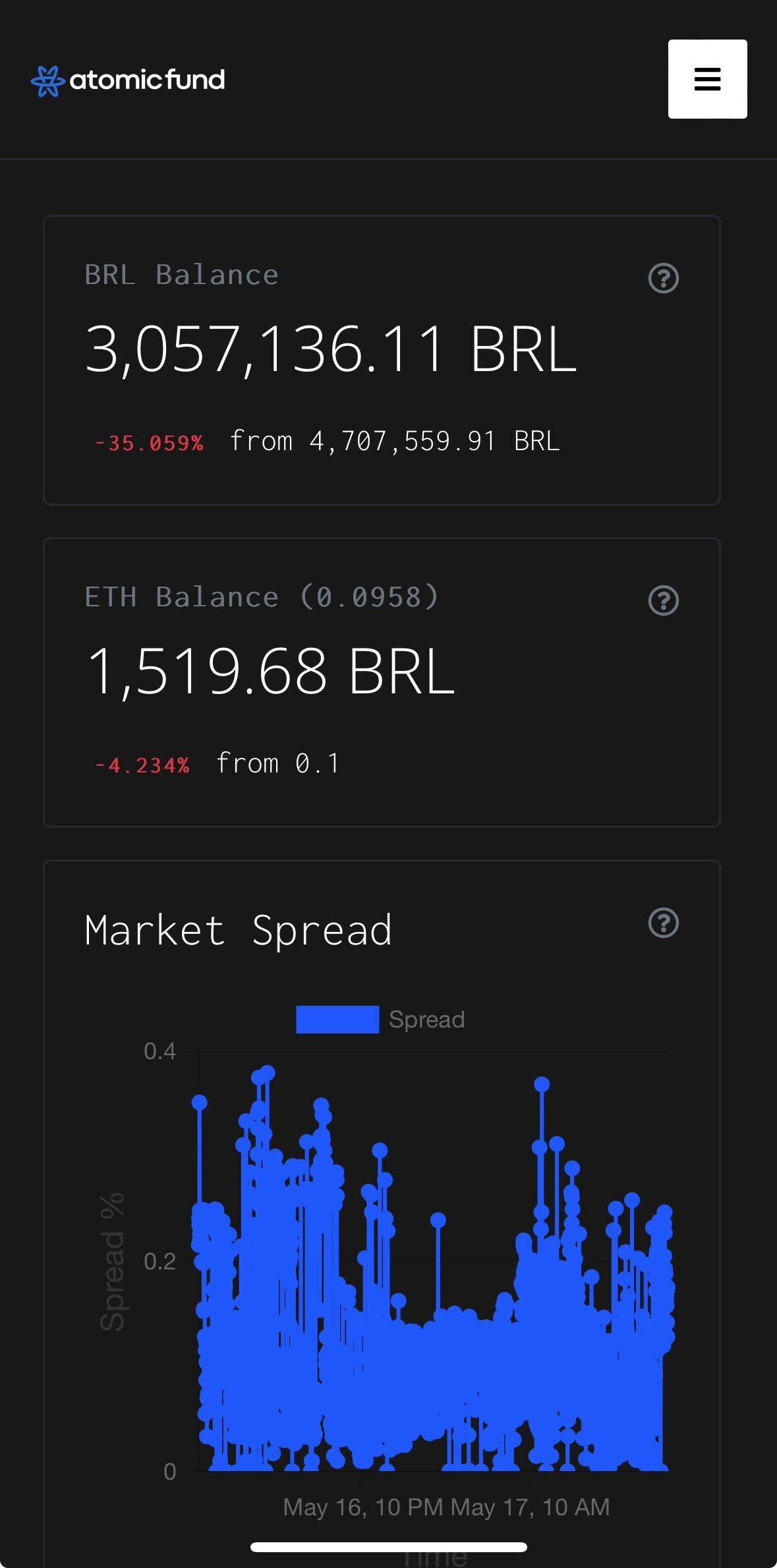

Atomic provides a robust product suite including offerings in execution, crypto market making, analytics and crypto trading workflow technology.

Fully customizable and designed specifically for the digital asset market.

With our risk-neutral and service-first philosophy, we aim at giving you the ease of deploying the right turn-key solution for your liquidity needs,supporting any given market at any time. Itegrated and hundreds of with more than 100M trading volume a day.